(In Chinese Only)

2020-05-26

於本月24日中原集團創辦人及主席施永青先生、中原集團子公司董事施慧勤小姐、中原投資管理有限公司總裁葉明慧小姐以及中原投資管理有限公司董事總經理江若雯小姐舉行記者招待會,跟到場各媒體朋友分享房地產投資業務開展消息,以及介紹英國學生公寓這種房地產類別的特性。

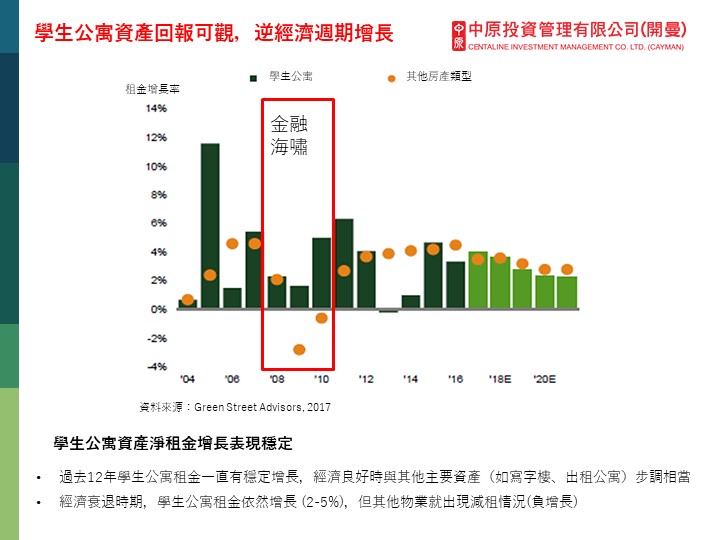

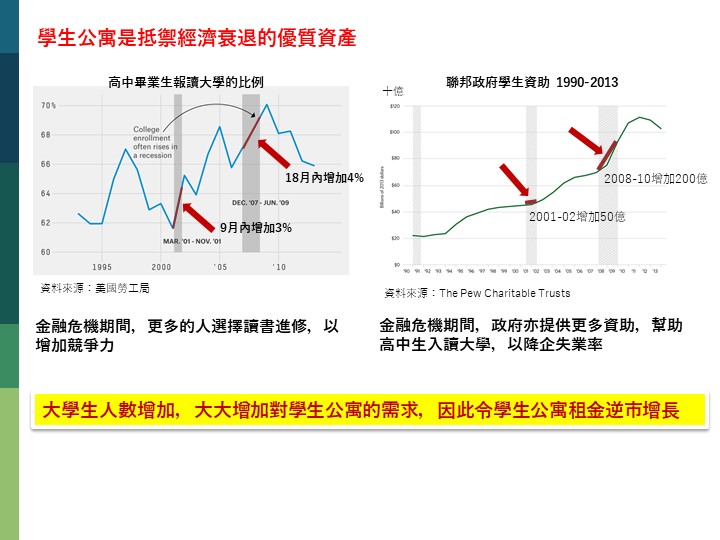

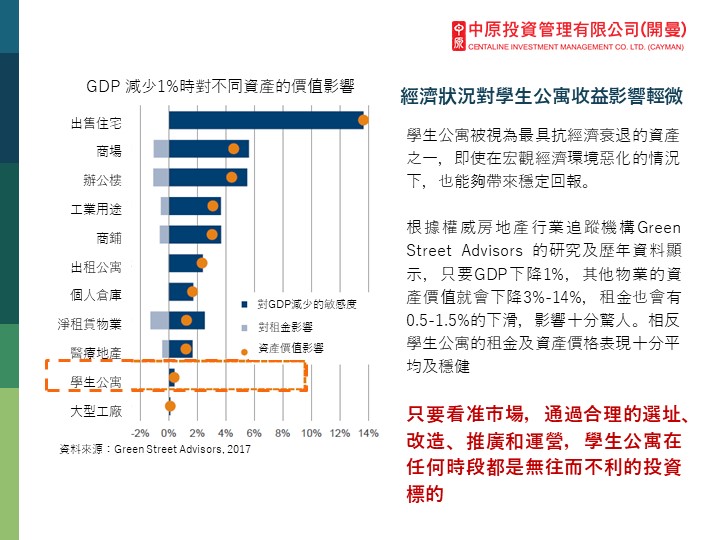

施永青表示中原看中學生公寓的穩定性,特別於疫情期間表現仍非常理想。中原投資了的美國學生公寓於疫情最嚴重時出租率仍達95%,收租率亦達95%以上,成績斐然。施永青表示一般家長就算面對經濟困難,花在子女身上的教育經費很少有影響。而全球就讀大學的人數有加無減,變相對學生公寓需求提供龐大支持,這亦確立了學生公寓市場的穩健性。施永青表示這類型投資特別適合高淨值人士,因為他們一般也擁有高風險高回報投資如股票,生意,而投資部分資金到學生公寓有助分散投資,達到資產配置效果。例如碰上突如其來市況,也總有一些投資提供穩健回報。就如中原美國學生公寓的投資,於疫情嚴重時仍能獲得4%租金收益。

葉明慧續解釋投資英國學生公寓原因之一為其長期處於供不應求狀況。英國就讀高等教育人數接近200萬,而全英國大學所提供的宿位只佔大學生人數 16.9%,這使得 83.1% 學生必須於大學附近尋找居所,從而造就一個龐大學生租務市場。這反映在私營學生宿舍的平均出租率長期高達98%。而英國學生公寓投資回報於2020年疫情嚴重期間還達到4.9%,抗跌力可見一斑。

施慧勤從用家角度為到場嘉賓作切身分享。 她表示自己和身邊很多朋友也於英國留學。 大家的首選一般是大學提供的宿位,因為既便利,又可享受大學氣氛。可惜大學宿位不足,所以他們很多都要在學生附近找地方居住,而他們一般也喜歡租住私人營運的學生公寓,因為一來還是會有大學氣氛,因為大家都是大學生。二來一般也相對自行租屋安全,因為私人營運的學生宿舍很多會提供拍咭安全系統、閉路電視,甚或乎一些比較大型的更有保安人員在場。 這讓入住學生及其家長甚為安心。 另外,由於私營學生宿舍以床位 / 房間為出租單位,學生無需以夾租形式承租,免卻夾租學生突然退租時讓承租學生承擔整份租金的風險。當然這類型宿舍一般不會再額外收取水電煤上網費用,支出有預算,亦避免自行申請以上服務的麻煩。一些具規模的宿舍甚至有閱讀室、遊戲室、健身室等設施,非常受學生歡迎。而由於私營學生宿舍能符合大部分用家需要,所以這些宿舍的出租率經常居高不下。而夾租住宅通常也淪為最後選擇,因為既沒有大學氣氛,沒有為學生而設的設施,同時還要承擔分租失敗風險等等。

江若雯進一步講解倫敦學生公寓市場情況。她表示倫敦是供求失衡最嚴重的城市,雖擁近30萬大學生,大學宿位卻只有44,033,即有85%學生需自己找尋居所。而倫敦很多大學也位於市中心,所以中原會收購的數個學生公寓項目也位處市中心Zone 1地區,10分鐘可步行到 Imperial College,騎單車或坐公共交通15分鐘亦能達 London School of Economics and Political Science (LSE), King`s College等大學。閒餘時步行到海德公園也只需5到7分鐘,各種生活配套也很充足,學生非常喜愛。

總結︰中原希望透過這次記者會讓香港市場了解更多不同投資類別,有助投資者分散風險,進行有效資產配置。