Recession Resilience of Student Apartments

2020-03-18

With the coronavirus Covid-19 pandemic wreaking havoc around the world and the global financial markets, circuit breakers have been kicked in a few times and investors continue to panic and suffer losses. Governments are adopting aggressive measures to try to curb the virus spreading and the impact is being felt across the economy. Many economists forecast that it is very likely the global economy will slump. Facing uncertainties much greater than normal, what is a safer bet for investors who are looking for investing opportunities during this pandemic?

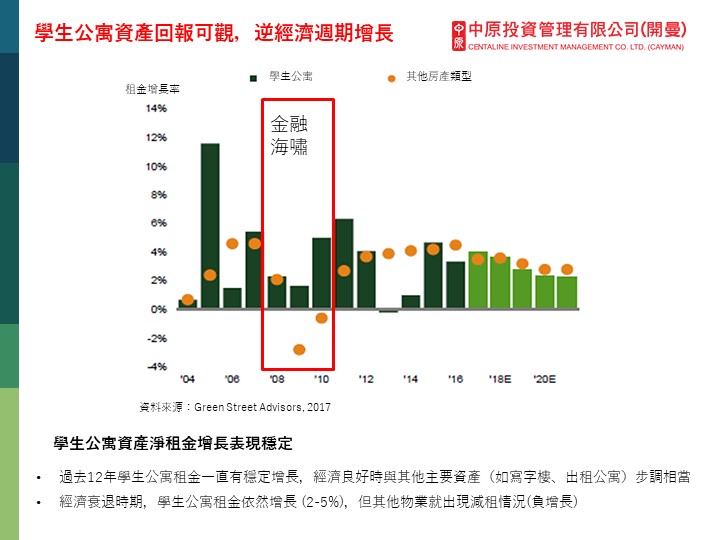

During economic recessions, it is a common belief that real estate properties would record lower rents and prices. However, many research have found that the “Recession Resilience” of student apartments is very high. During the 2008 Global financial crisis, the rental return of student apartments were very stable and the asset prices did not fluctuate greatly. After the crisis, it attracted many investments from large insurance companies, sovereign funds, pension funds, and so on.

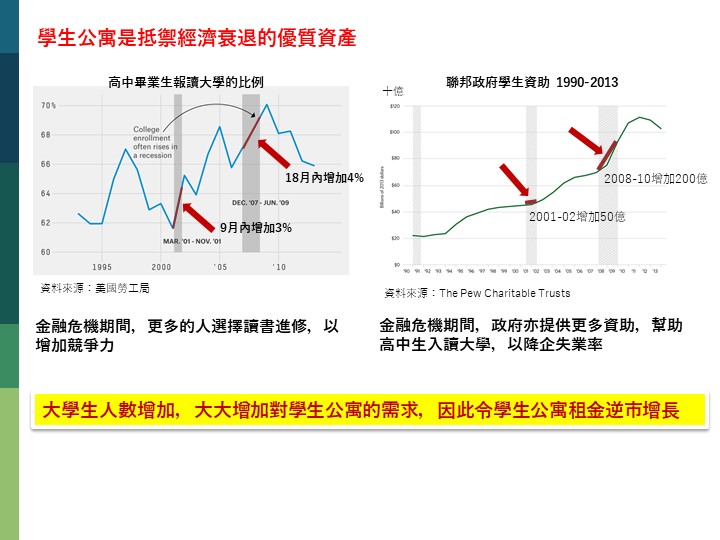

Why did this happen? Research revealed that during economic downturns, redundant or unemployed workers chose to further their study in order to improve their job prospects. Governments also incentivised students to delay their graduation to reduce unemployment rates. It was therefore logical that the rent of student apartments increased against the market trend with more college students studying and in need of accommodation.

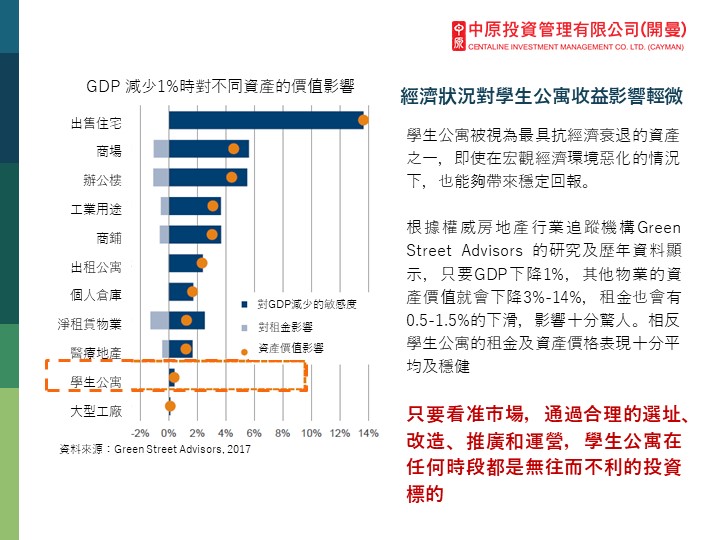

According to Green Street Advisors, the industry leader in REIT research, as long as GDP falls by 1%, the asset value of properties, such as shopping malls, offices and hotels, would fall by 3% -14%, and rents by 0.5 -1.5%. However, the rent of student apartments is contrariant to this trend. In the past 12 years (including the period of 2008 Global financial crisis), the rent of student apartments has been steadily increasing (2-5%).

Therefore, targeting the right sector and through astute selections of projects, it is still possible to find stable investment opportunities in student apartments during crises.